- #Three generally accepted auditing standards professional

- #Three generally accepted auditing standards free

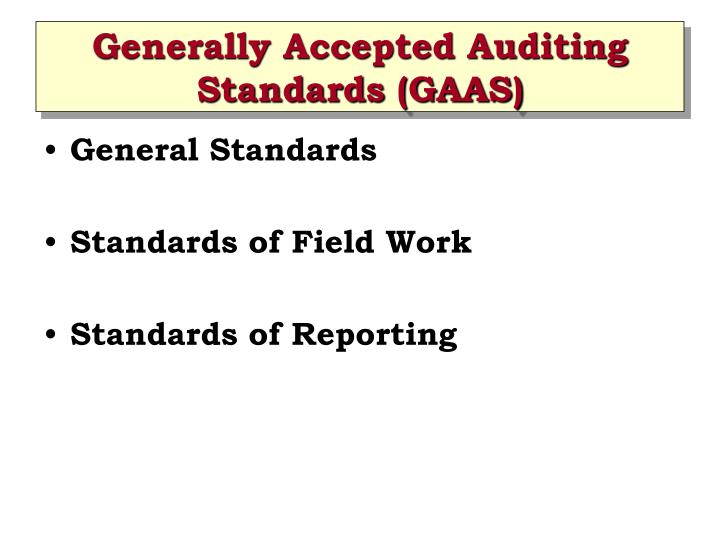

Criteria for competence, independence, and. All organizations are now required to issue their Service Auditor Reports under the SSAE 16 standards in an SOC 1 Report. Financial statements presented in accordance with GAAP What is the general character of the three generally accepted auditing standards classified as general standards. SSAE16 is now effective as of June 15, 2011, and if you have not made the necessary adjustments required, now is the time to find a quality provider to discuss the proper steps. In reporting the audit results, the auditor must meet four reporting standards. The sufficient competent evidential matter is to be obtained through inspection, observation, inquiries, and confirmations to afford a reasonable basis for an opinion regarding the financial statements under audit. Obtaining sufficient competent evidential matter Understanding the internal control structureĪ sufficient understanding of internal control is to be obtained to plan an effective and efficient audit.

The work is to be adequately planned, and assistants, if any, are to be properly supervised. The fieldwork standards are so named because they pertain primarily to the conduct of the audit at the client’s place of business in the field. The standard of due care requires the auditor to act in good faith and not to be negligent in an audit. The auditor must be diligent and careful in performing an audit and issuing a report on the findings.

#Three generally accepted auditing standards professional

The auditor must also meet the independence requirements of the AICPA’s professional conduct.

#Three generally accepted auditing standards free

The auditor must be free of client influence in performing the audit and reporting the findings. Continuous professional education during the auditor’s professional career.The GAGAS are also known as the Yellow Book and were established by the Government Accountability Office (GAO). Practical training and experience in auditing, and Generally Accepted Government Auditing Standards (GAGAS) The 5 GAGAS are followed by the auditor when auditing the financial and/or performance audits of the government agencies.

0 kommentar(er)

0 kommentar(er)